After this experience, I can no longer recommend using any CEX (Centralized Exchange). Let Bitpanda serve as a lesson in why we need to question centralized platforms—and demand better.

Bitpanda has been one of my go-to centralized exchange for years. I've trusted them with my hard-earned money, enjoyed lightning-fast deposits and withdrawals, competitive staking rewards, and their promise: "Start investing with as little as €1." But is that still true?

Recently, curiosity got the best of me, and I decided to test Bitpanda's claim directly. I attempted to stake €1 on every staking asset available, just like the platform promises you can. The results? Frankly, shocking—and not at all what Bitpanda wants long-time users like me to discover.

Let me walk you through my real experience, with proof in hand.

Why I Trusted Bitpanda

Picture this: it's May 2019 and I'm just discovering cryptocurrencies as a potential investment.

Bitpanda stood out with its super easy-to-use interface—gold for a beginner like me. It let you start investing with as little as €1, offered a wide selection of assets and products, had no deposit or withdrawal fees, and boasted clear Terms and Conditions.

Soon, I discovered another "awesome" feature: staking. (For those unfamiliar, staking is—very simply—how many blockchains validate their transactions: you lock up your coins to help secure the network, and in return you earn rewards. It's a bit like stocks and dividends, although not exactly the same.)

Bitpanda offered pretty good staking rewards, no lock-up periods, and "transparency" about their processes. At least, that's what I thought.

Fast Forward: The €1 Staking Experiment

Let's skip ahead to April 16, 2025. I decided to run a little experiment: does this big European centralized exchange still live up to its word—"Start investing with as little as €1"?

Step 1, I carefully read the staking Terms & Conditions. They seemed unchanged: minimum €1 to earn rewards, minimum €0.01 weekly reward to trigger a payout.

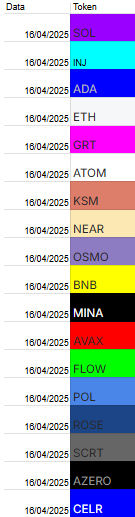

Step 2, I checked their advertised list of stakeable assets. For reference (as of yesterday, and possibly just before they changed it after I complained...), here's the list:

Sui, IOTA, Chilliz, Cosmos, Coreum, Axie Infinity Shard, bitsCrunch, Secret, Kava, Kusama, Audius, Casper, Aleph Zero, Starknet, Osmosis, Celestia, The Graph, Flow, IRISnet, Polkadot, Injective, Akash, Harmony, Mina, Near Protocol, Zilliqa, Moonbeam, Ronin, Moonriver, Solana, Algorand, MultiversX, Fetch.ai, Core Dao, Aptos, cheqd, Sonic, Avalanche, Axelar, Celer Network, ZetaChain, Aave, Saga, Tron, Sei, Polygon, Tezos, Dymension, Ethereum, Cardano, Oasis Network, Hyperliquid, BNB.

I was already "hodling" some, but for this experiment, I decided I'd buy €1 of each and every asset listed. (Now I'm feeling a little bit like an Indian after saying that, lol.)

And I was determined to follow the Bitpanda Staking Terms & Conditions to the letter: buy €1 of each asset, and buy on "red days" to get better prices.

Here's a table I kept of my staking attempts: every asset I purchased was above Bitpanda's own minimum threshold in the Staking Terms & Conditions. And yet, not a single one generated any rewards.

My final personal take? Sometimes it's not about the money—it's about principles. Bitpanda embraces everything that cryptocurrencies were designed to avoid: centralization and lack of transparency. I'll be closing my account on their platform as soon as possible. Never before has this phrase resonated so deeply with me: "Not your keys, not your crypto." So Bitpanda, it's been an interesting journey, but your services are no longer needed. Ade.

Until we meet again, stay true, stay Cryptoniac.